To begin Cap Rate calculations, you will need to calculate (or estimate) ‘Net Operating Income’ (NOI), which we have covered above. The Current Market Value of the Property (Or, asking price, if you’re purchasing).What Information Will I Need to Calculate Cap Rate? Given the current market value, if a property is providing a lower Cap Rate than its market comparisons, you may need to lower costs and improve the effectiveness of management. While less common, owners sometimes calculate Cap Rate on their existing investments. If the ratio of income to asking price for a property does not compare favorably against other similar properties in the area, based on the potential income, you might have some leverage to negotiate a better price. What is Cap Rate Used For?Ĭap Rate is useful in analyzing the asking price of a property when you’re considering a purchase. It is arguably the most-used of the rental property calculators when purchasing property. In other words, Cap Rate is a quick estimate of the rate of return on a rental property. The Capitalization Rate, or Cap Rate, is a ratio of the potential income of a rental to the property’s purchase cost.

Noi calculation for real estate software#

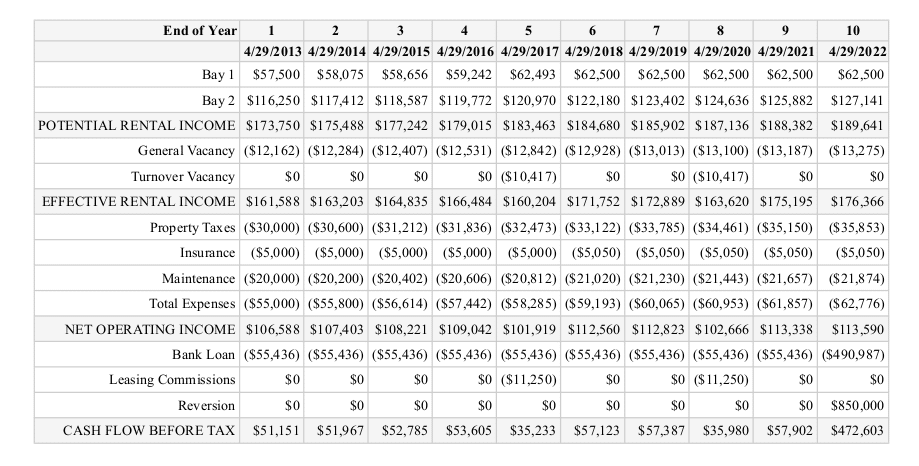

Related Read: Reporting and Accounting Tools: Best Accounting Software for LandlordsĬapitalization Rate (Cap Rate) What is Capitalization Rate (Cap Rate)? Gross Operating Income – Operating Expenses = Net Operating Income Use our simple net operating income rental property calculators or follow the formula below: ‘Operating Expenses’) from the yearly rental income earned (i.e. Once you’ve calculated the ‘Gross Operating Income’ and ‘Operating Costs’, you will be able to subtract the running costs (i.e. Generally, NCF = NOI – mortgage payments.

NCF is the difference between your property’s cash inflows (what comes in) and outflows (what goes out) over a certain period of time. However, keep in mind that NOI is not the same thing as Net Cash Flow (NCF). By leaving these out of your calculations, you can eliminate factors that differ from property to property and obtain more accurate data for comparing potential rental investments on a head-to-head basis. You will also need to calculate the ‘Operating Expenses’ you may incur, such as:īecause mortgages vary between investments, your NOI calculations should not include your mortgage. To determine NOI, firstly you will need to calculate all of the income a property generates (i.e. What Information Will I Need to Calculate NOI? Determining the NOI of a property helps you decide if the profit made from the investment makes the purchase worthwhile. Take note, however, NOI does not factor in the cost of your mortgage.

What is NOI Used for?Ĭalculating NOI will allow you to find how much money a property earns after accounting for all of the Operating Expenses. maintenance, insurance, property taxes, utilities, etc). Essentially, it calculates the revenue generated from a property after subtracting your Operating Expenses (e.g. In short, Net Operating Income (NOI) is an important indicator in determining the profitability of a potential real estate investment.

Noi calculation for real estate how to#

Before jumping into real estate investing or making a new purchase, it is important to understand how to calculate metrics that will help you make the best decisions.

0 kommentar(er)

0 kommentar(er)